⚠️ Urgent! For Self-Employed Individuals...

⚠️ Urgent! ⚠️

For Self-Employed Individuals...

You may Be Missing Out on up to $32,220 in tax Credits from 2020 & 2021!

Important! Watch This Short Video First 👇

Next Step:

STEP 1:

Create A Free, Secure Account Below:

$60 Billion dollars is up for grabs but expires soon. This is not the ERC or PPP. It's a little-known tax credit for self-employed individuals.

• It takes less than 5 minutes to see if you qualify

• NO UPFRONT FEES

• This is NOT a loan - NO payback!

• It is NOT taxable

• You can still get paid even if you owe the IRS

• Receive funds in as little as 10 business days!

(If you have trouble with the button, copy and paste this url in your browser)

(If you have trouble with the button, copy and paste this url in your browser)

The SETC is a specialized tax credit designed to provide support to self-employed individuals during the COVID-19 pandemic.

It acknowledges the unique challenges faced by those who work for themselves, especially during times of illness, caregiving responsibilities, quarantine, and related circumstances. This credit can be a valuable resource for eligible individuals to help bridge financial gaps caused by unforeseen disruptions.

Almost everybody with Schedule C income qualifies.

Amidst the pandemic, millions grappled with COVID-related challenges, including illness, symptoms, quarantine, and caregiving responsibilities. If you found yourself in such situations, where COVID impacted your ability to work, the SETC was designed to be your safety net, but it’s not too late.

Act Fast While You Can Still Apply!

Self-Employed Status:

If you were self-employed in 2020 and/or 2021, you could potentially qualify for the SETC. This includes sole proprietors who run businesses with employees, 1099 subcontractors, and single-member LLCs. If you filed a “Schedule C” on your federal tax returns for 2020 and/or 2021, you’re on the right track.

COVID Impacts:

Whether you battled COVID, experienced COVID-like symptoms, needed to quarantine, underwent testing or cared for a family member affected by the virus, the SETC could be your financial relief. If the closure of your child’s school or daycare due to COVID restrictions forced you to stay home and impacted your work, we’re here to help.

Get Started With Your Application Today!

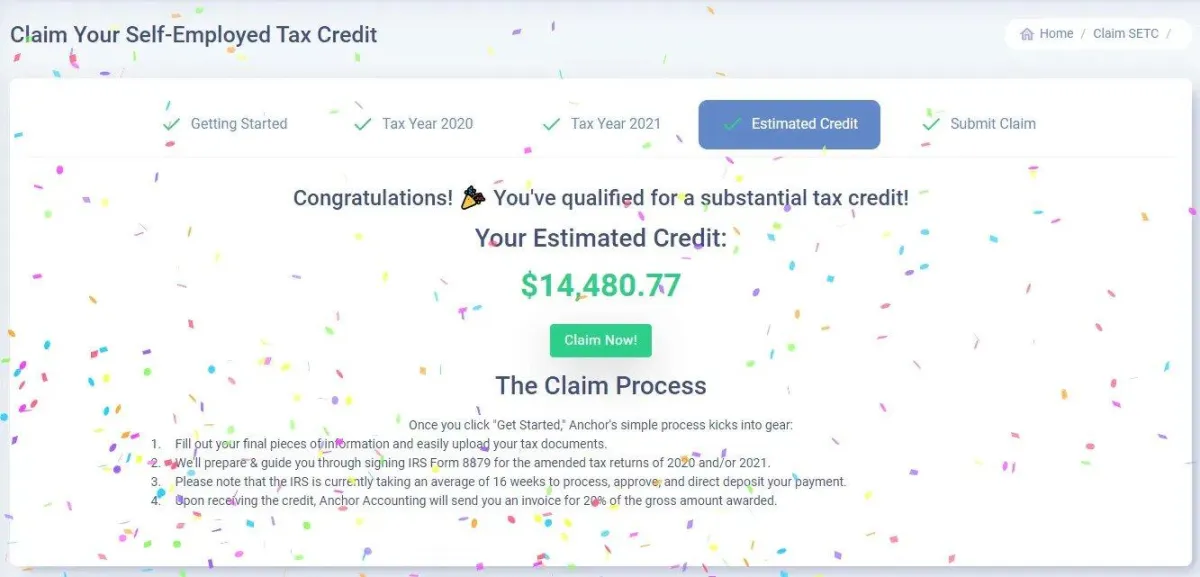

Affiliate Team Pro™ has partnered with Gig Worker Solutions and Anchor Accounting Services to bring you a seamless submission experience for your SETC application to ensure you get the maximum amount you're qualified for and to provide you an exclusive 10 business day rapid funding option.

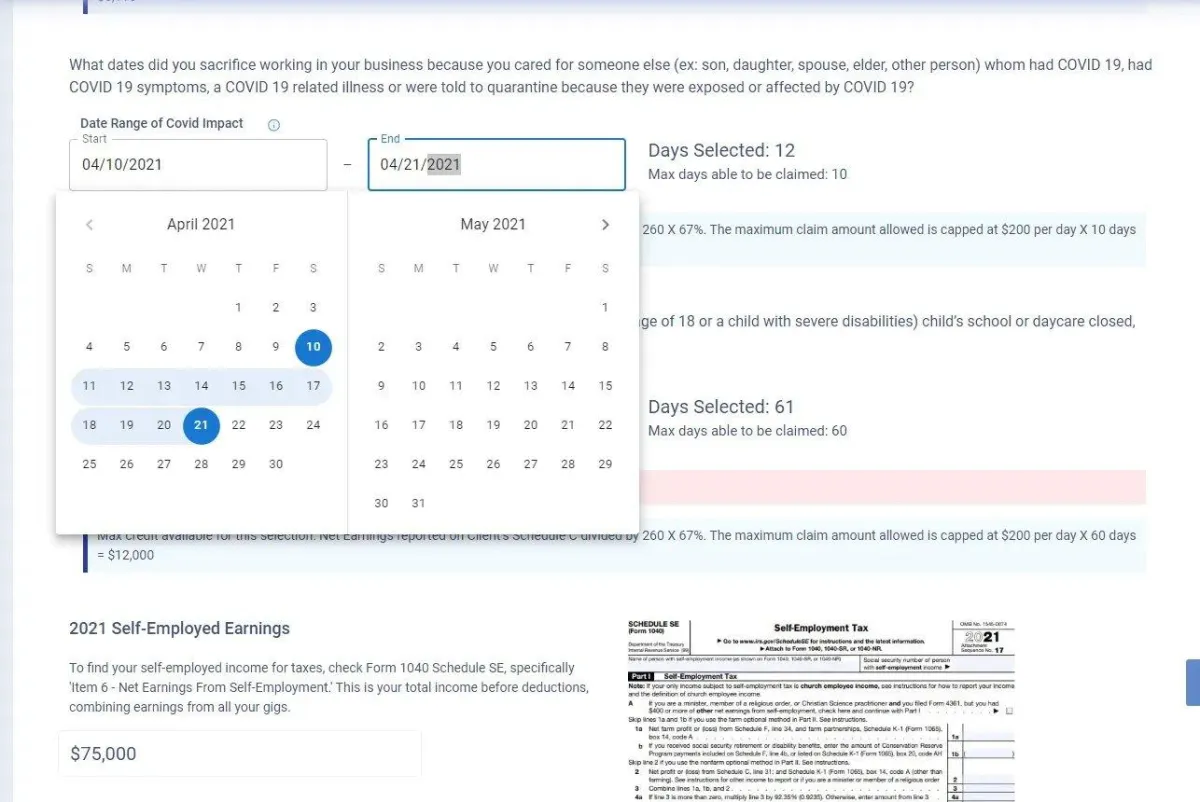

Simply enter any disruptions to your business due to COVID-19 during 2020 and/or 2021.

If you experienced any COVID-related disruptions to your business, you could qualify for the SETC. This includes illness, symptoms, quarantine, testing, and caregiving responsibilities. If you were forced to stay home due to the closure of your child’s school or daycare, you could qualify as well.

Calculate and discover your potential tax credit amount.

Discover how much you could receive in tax credits by entering your information into our calculator. You could recover up to $32,220 in tax credits from 2020 and 2021!

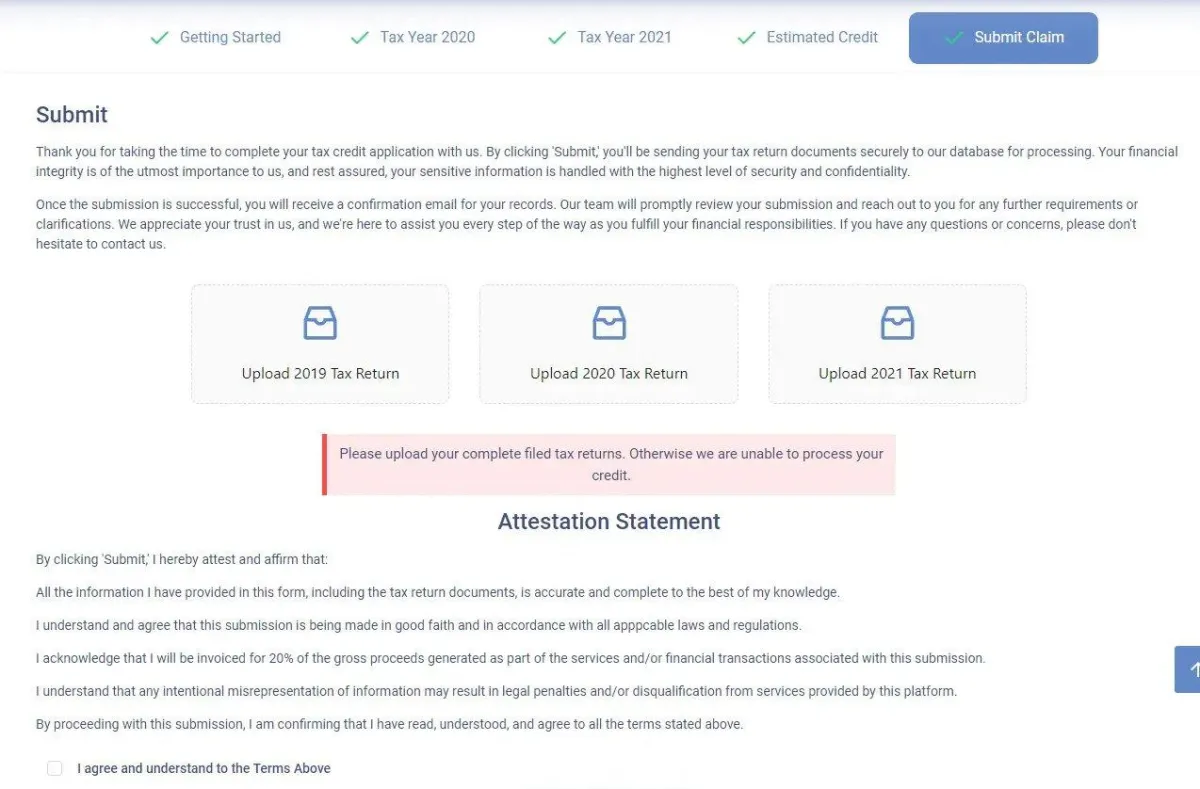

Submit your tax returns, and Anchor will do the rest.

Anchor's team of tax professionals will review your application and submit it to the IRS on your behalf. If you qualify, you'll receive your tax credit in the form of a refund or a reduction in your tax liability. If you don't qualify, you won't pay a dime.

Need Help Completing The Application?

The application process is quick and efficient, consisting of just six questions. Rest assured that we understand the importance of your time, which is why we've designed a streamlined process that will guide you through each question with ease. Our user-friendly interface ensures a hassle-free experience, making it convenient for you to complete the application in no time. So sit back, relax, and let us handle the rest.

What Documents Are Required?

The only documents required to complete your analysis are the 2019, 2020 and 2021 Tax Returns (1040s with Schedule C).

FAQ

What is the Sick & Family Leave Tax Credit?

The Sick and Family Leave tax credit for self-employed and 1099 workers is for eligible self-employed individuals or independent contractors.

Under the FFCRA, eligible self-employed individuals or independent contractors could claim a refundable tax credit against their income tax liability for up to 100% of the qualified sick and family leave equivalent amounts, subject to certain limitations if they were unable to work or telework due to COVID-19-related reasons.

The qualified sick leave equivalent amount was the lesser of either $511 per day or 100% of the average daily self-employment income for each day an individual was unable to work or telework because they were subject to a quarantine or isolation order, had COVID-19 symptoms and were seeking a medical diagnosis, or were caring for someone who was subject to a quarantine or isolation order or who had COVID-19 symptoms.

The qualified family leave equivalent amount was the lesser of either $200 per day or 67% of the average daily self-employment income for each day an individual was unable to work or telework because they needed to care for a child whose school or place of care was closed due to COVID-19.

To claim the tax credit, eligible self-employed individuals or independent contractors would report the qualified sick and family leave equivalent amounts on their 2019, 2020, or 2021 tax returns, depending on when their leave was taken.

How do I complete the application?

Please reference the "Need help completing the application" video above.

What documents are required?

Please reference the "What Documents are Required?" video above.

What if I already filed my taxes for 2020 & 2021?

We will need to file an amendment on your tax return. We do this all the time. All we require from you is a copy of your 2019, 2020 and 2021 tax returns and a copy of your drivers license and we’ll handle the rest.

Do I have to fill out a ton of paperwork?

Not at all. Our website has an agreement letter that you must read, sign, and date. You will also need to upload a copy of your 2019, 2020, and 2021 tax returns and a copy of your driver’s license. That’s it.

We make the process as easy and stress-free as we can for you. Once we have your tax returns, we’ll take over and get everything filed for you.

Do I have to be self-employed to file for the tax credit refund?

Yes. This tax credit is for self-employed individuals, small business owners, freelancers, and 1099 contractors only.

How much of a tax credit can I expect to receive?

A few factors go into calculating your tax credit refund amount. The most significant factors would be:

1. Your net income from your Schedule C on your 2019, 2020, and 2021 tax returns.

2. How many days you were out sick or told to quarantine with Covid-19

3. How long you might have cared for a loved one affected by Covid-19?

4. How long were schools or daycare centers closed (and you were forced to care for a minor child during the closings)

How long before I will receive my cash refund?

In as little as 10 days! Once we receive the necessary paperwork from you, we will begin to work on your case and get all the forms filed, etc.

How do I know if I am eligible beyond having 1099 income?

Did you have COVID?

Did you test positive for COVID?

Did you go get tested?

Did you have Covid-like systems?

If you experienced Covid-like systems that caused you to be ineligible to go work, to make money, to provide for your family.

If you couldn’t sell.

If your children’s schools were closed, if your children’s daycare was closed, if you had family that had COVID that you had to help them out and stop what you were doing, or had covid-like systems or were quarantined.

If this enabled or limited you from making money during COVID, you are likely eligible!

Does the IRS provide information on the SETC?

Yes, here's the IRS news release.

What if I received PPP and ERC?

You can receive PPP, ERC, and SETC.

What if I received a W2 from my employer BUT also received a 1099 Income during COVID?

As long as you received the 1099 income as a Sole Proprietor, Partnership, or Single-member LLC and it is separate from your W-2 income, you are likely eligible.

Do I have to pay taxes on the money I receive back?

No, the SETC is Tax-Free

When does the SETC End?

April 15, 2024. Apply before it is too late!

Can I contact to someone about my situation?

Absolutely. You can contact us at support@gigworkersolutions.com or 804-377-4770.

©2023 Affiliate Team Pro™ | All Right Reserved

Privacy Policy | Terms of Service | Refund Policy | Affiliate Agreement